Save Time: Get 5 Simple Writing Tips

you can put to use in 10 minutes

How to Write an Annual Contribution Summary Letter

Award-winning writer Kathy Widenhouse has helped hundreds of nonprofits and writers produce successful content , with 750K+ views for her writing tutorials. She is the author of 9 books. See more of Kathy’s content here.

You know it’s time to send out annual contribution summary letters to last year’s donors when the calendar turns over from one year to the next.

But why send them if you have sent out donation receipts during the year? Technically, if your periodic receipts have included the 5 magic pieces of information (see below), then you’re not required to send a summary.

But there a few good reasons why it’s a good idea.

The 3 R’s of Annual Contribution Summaries

Relationship

A year-end gift statement provides yet another opportunity to keep a connection with your donor, thank him for his generosity, remind him what his giving helped to accomplish, and express hope that the relationship will continue in the coming year. (More about building relationships through letters.)

Record-keeping

The process (tedious though it may be) of updating your data base, correcting addresses, and checking gift details allows your nonprofit to stay focused on accounting best practices. Further, putting it all on paper allows you and your donor to mutually confirm that your records are in order.

Regulations

A year-end gift receipt or summary ensures, without a doubt, that you’re in compliance with the IRS (or other government agency, for those nonprofits who are chartered in a country outside the U.S.)

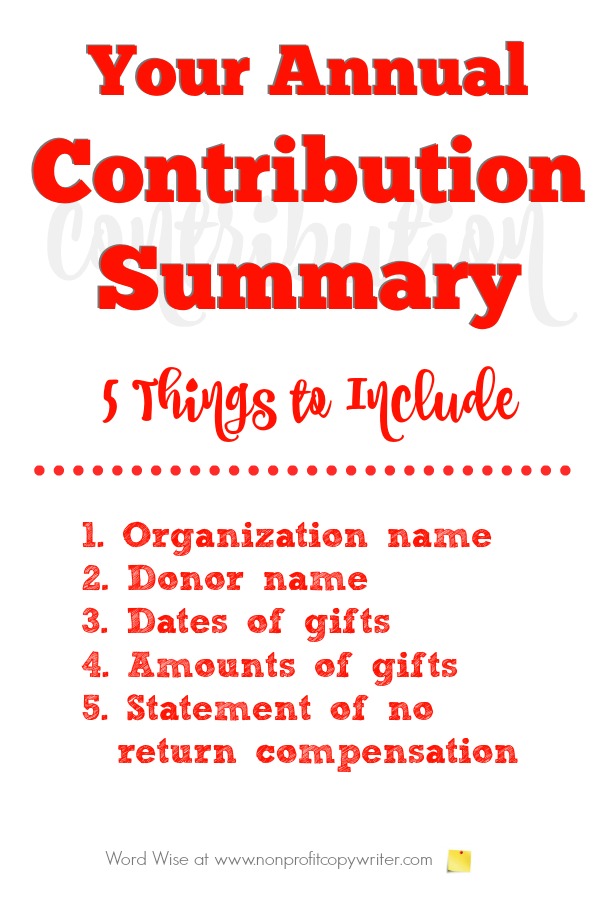

5 Magic Ingredients of Your Annual Contribution Summary

The 5 magic pieces of information your annual contribution summary must have:

- Your organization’s name

- The donor’s name

- The date(s) of contribution(s)

- The amount(s) of contribution(s)

Bonus: the total amount of contribution(s) received for that calendar year, if more than one gift. (Your donor will bless you for this information since it means he will have a clear figure to check against his own.) - A statement explaining whether or not your organization provided any goods or services in exchange for these gifts. Here is an example:

No goods or services in whole or part were received in exchange for your gift.

(You can read the official U.S. regulations in IRS Publication 526: Charitable Contributions)

FAQs: Frequently Asked Questions about Year-End Statement Letters

Q. May I simply report a year-end gift summary to a donor over the phone?

A. Your letter must be printed to be official (versus verbal.)

Q. What must my annual contribution summary letter look like?

A. It can take any printed format you choose, as long as it includes the required 5 magic pieces of information.

Q. If I mailed a receipt every time a donor sent a gift, must I send a year-end summary?

A. As long as you included the above-mentioned 5 magic pieces of information in each receipt, an annual contribution statement is not required. However, if you read the 3 R’s to Annual Contribution Summaries (above), you can see that sending these letters is a really good idea.

Q. Do I have to include a letter? It would be easiest just to send the 5 magic pieces of information in a print out.

A. You don’t have to include a letter. But this is a wonderful opportunity to once more connect with your donor and share how her partnership is impacting lives. Do everything possible to take the opportunity to cultivate the relationship!

Q. How do I handle in-kind gifts?

A. Acknowledge that you have received them, providing a description of the item and the date it was received. But let the donor estimate the value of the gift.

More on Fundraising Writing

Donor acknowledgement: a fancy way to say "thank you" ...

How to write the perfect donor thank you letter ...

What I learned about than you letters from a 5-year-old ...

Donor thank you: the simplest way to friendraise ...

What your fundraising letter must have ...

Get more tips on our Fundraising Writing Pinterest board ...

Return from How to Write an Annual Contribution Summary to

Nonprofit Copywriter home

As an Amazon Associate I earn from qualifying purchases.

Share This Page

Named to 2022 Writer's Digest list

BEST GENRE/NICHE WRITING WEBSITE

Stop Wasting Time!

Grab your exclusive FREE guide, "5 Simple Writing Tips You Can Put to Use in 10 Minutes or Less"